Costs

Oct 28, 2020 Copayments for prescriptions available through Tricare's home delivery program also will remain the same, a 90-day supply of a generic drug delivered by mail will be $10, a brand-name medication. TRICARE retail network pharmacies At a retail network pharmacy, your copayments for up to a 30-day supply of generic formulary drugs will increase from $11 to $13. For brand-name formulary drugs, the increase is from $28 to $33. Non-formulary drugs will increase from $53 to $60.

Find your TRICARE costs, including copayments,enrollment fees, and payment options.

- TRICARE Reserve Select (TRS) TRICARE Retired Reserve (TRR) 2020: E4 and Below: $52/individual, $104/family E5 and Above: $156/individual, $313/family. 2021: E4 and Below: $52/individual, $105/family.

- See full list on tricare.mil.

- Effective January 1, 2020 TRICARE costs will increase. Retirees with the TRICARE Prime benefit who do not carry Medicare Part B will also see small copay increases in some medical categories. In addition, these retirees will see a 1% increase in premiums. US Family Health Plan is a TRICARE Prime program so these increases apply to its members.

With the point-of-service option, you:

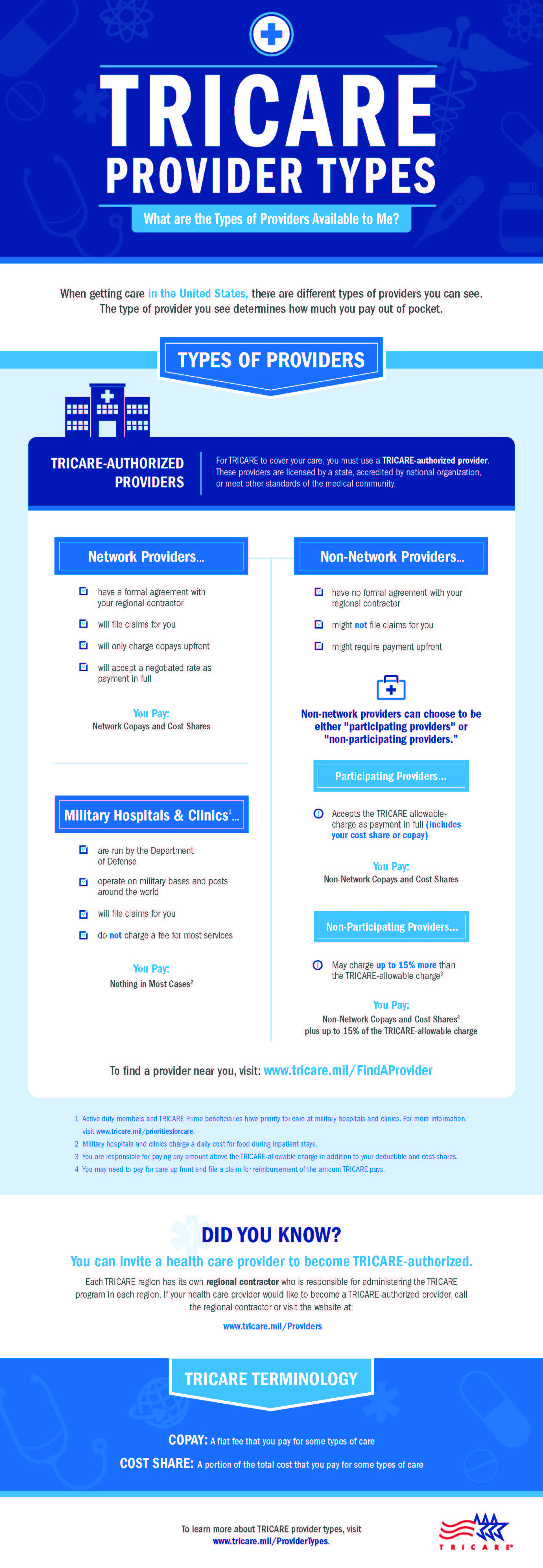

- Can visit any TRICARE-authorized providerAn authorized provider is any individual, institution/organization, or supplier that is licensed by a state, accredited by national organization, or meets other standards of the medical community, and is certified to provide benefits under TRICARE. There are two types of TRICARE-authorized providers: Network and Non-Network. DS

- Get routine care

- Don’t need a referral

- Pay more out of pocket (see fees below)

The point-of-service option doesn't apply if you:

- Are an active duty service member

- Use a non-Prime plan

- Have a referral. (If you have a referral and/or authorization, your costs are the same as network costs.)

- Have a newborn or adopted child (until enrolled in TRICARE Prime)

- Note: Children are covered by TRICARE Prime for 90 days (120 days overseas) after birth or adoption as long as one other family member is enrolled. The point-of-service option won't apply to children during this time or until the date the contractor receives the enrollment form.

- Have other health insuranceHealth insurance you have in addition to TRICARE, such as Medicare or an employer-sponsored health insurance. TRICARE supplements don’t qualify as 'other health insurance.'

- Use the following type of care

- Preventive care from a network provider in your region**

- In some cases, urgent care

**If you visit a network provider in another region without a referral from your PCM, you're using the point-of-service option.

Point-of-Service Fees

When you use the point-of-service option, you’ll pay:

- Point-of-service fees instead of your regular copaymentA fixed dollar amount you may pay for a covered health care service or drug.

- Any other fees charged by non-network providers

These fees don’t apply to your annual catastrophic cap.

| Outpatient Deductible | Cost-Shares |

|---|---|

You must pay this amount before cost sharing begins for outpatient services.

| Outpatient Services: 50% of TRICARE allowable chargeThe maximum amount TRICARE pays for each procedure or service. This is tied by law to Medicare's allowable charges. Hospitalization: 50% of TRICARE allowable charge |

Last Updated 6/28/2019

Find a Doctor

Annual deductibles apply to network and non-network providers for outpatient services only.

- Deductibles must be met before TRICARE benefits are payable.

- Once the deductible is met, cost-shares apply.

- Network providers can collect at a minimum the copayment at the time of service. A provider may also collect the outstanding balance of the deductible. The explanation of benefits (EOB) will inform the beneficiary and provider of the allowed amount and patient responsibility.

- Deductibles apply to the catastrophic cap.

- TRICARE Select, TRICARE Young Adult Select, TRICARE Reserve Select, and TRICARE Retired Reserve deductibles do not apply to preventive services.

- Exception: Deductibles will apply to routine eye examinations (when covered), school physicals and assignment-ordered physicals, when performed by non-network providers.

Tricare Cost Share 2021

A beneficiary's deductible is determined by the sponsor's initial enlistment or appointment date:

- Group A: Sponsor's enlistment or appointment date occurred prior to Jan. 1, 2018.

- Group B: Sponsor's enlistment or appointment date occurred on or after Jan. 1, 2018.

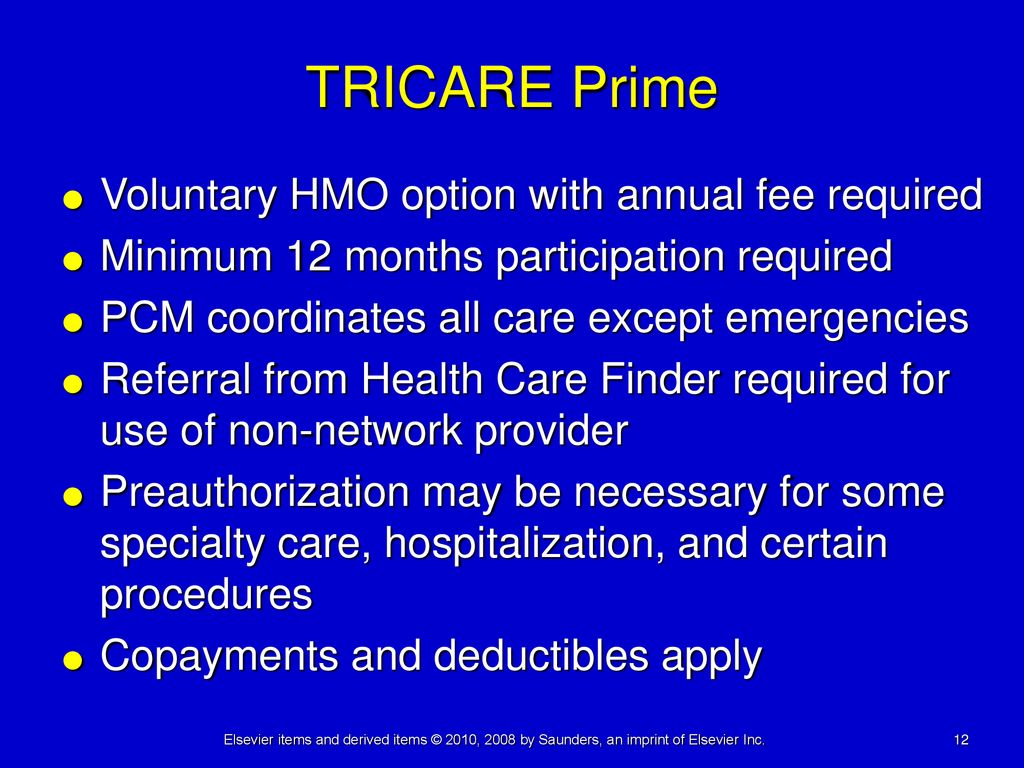

TRICARE Prime and TRICARE Prime Remote (not including TRICARE Young Adult)

| Active Duty Family Members | Retirees and Their Family Members |

|---|---|

Group A: $0 Group B: $0 Point of Service deductibles are calculated separately. | Group A: $0 Group B: $0 Point of Service deductibles are calculated separately. |

Tricare Prime Copay 2020 Form

TRICARE Select (not including TRICARE Young Adult)

Cached

| Active Duty Family Members | Retirees and Their Family Members |

|---|---|

Group A: Group B: 2020: E4 and Below: $52/individual, $104/family 2021: E4 and Below: $52/individual, $105/family | Group A: Group B: 2020: Network Providers: $156/individual, $313/family 2021: Network Providers: $158/individual, $317/family |

TRICARE Reserve Select (TRS) and TRICARE Retired Reserve (TRR)

| TRICARE Reserve Select (TRS) | TRICARE Retired Reserve (TRR) |

|---|---|

2020: E4 and Below: $52/individual, $104/family 2021: E4 and Below: $52/individual, $105/family | 2020: Network Providers: $156/individual, $313/family 2021: Network Providers: $158/individual, $317/family |

TRICARE Young Adult

TRICARE Costs And Fees 021

The TRICARE Young Adult deductible is based on the sponsor's status.

Tricare Prime Copay 2020 Part

| TRICARE Prime | TRICARE Select | ||

|---|---|---|---|

| Active Duty Family Members | Retiree Family Members | Active Duty Family Members | Retiree Family Members |

| $0 | $0 | 2020: 2021: | 2020: 2021: |